Why choose The Accountant Network?

The Accountant Network serves as the accounting backbone for our business, and our extensive experience with them has been nothing but positive. Finding a combination of transparency, expertise, and simplicity in an accountant is truly a rare gem, especially considering the affordability of their fees. One notable advantage of working with The Accountant Network is the robust connection we share. While we handle any technical support you require, our partner ensures the provision of unwavering financial support, creating a seamless collaboration - all your support needs met in a single, reliable source.

Payroll Management

Bookkeeping

VAT Returns

Business Plan Preparation

Cash Flow Forecasting

Start-ups

How The Collaboration Benefits You?

Based on our experience, managing multiple companies concurrently for different purposes can pose challenges due to each entity having its unique approach to addressing difficulties and how the communication is dealt with. Fortunately, we have overcome this hurdle by partnering with The Accountant Network. This collaboration ensures that you remain within a unified business circle, allowing us to handle issues cohesively as a single entity, rather than navigating the complexities of coordinating multiple workloads from different businesses.

Accountant Services

Payroll Management

Whether you’re looking for an accountant to fully manage your business’s entire payroll, just require partial assistance, or simply need advice on payroll legislation, then we’re here to help. By working with The Accountant Network, we can help you make your payroll processes more time efficient and setup a more automated system allowing you to focus your attention on developing your business.

Bookkeeping

Here at the Accountant Network, we understand that bookkeeping is a time-consuming process. It can be challenging managing your daily business needs while ensuring your cash management is efficient and your accounts are operating to UK regulations. Our expert accountants can manage all your daily bookkeeping needs for you, ensuring that accurate and detailed records are maintained all year round.

VAT Returns

Failure to submit an accurate VAT Return to HM Revenue & Customs will mean your business could incur penalties. Our highly experienced tax accountants are here to guide you through ever changing VAT laws and regulations. We can ensure your quarterly VAT returns are submitted accurately and on time and making sure you are on the best VAT scheme. Additionally we advise if you need to switch to a more effective one for your business type.

Business Plan Preparation

A well-developed business plan helps you structure long term actions for your company and are vital for generating interest from potential investors. Once your business plan is in place, we will help you analyse and review it. We work closely with you to make sure your business plan is not only viable, but helps you make informed decisions for the future.

Cash Flow Forecasting

Cash flow is what keeps your business alive but creating an accurate cash flow forecast can be overwhelming. Our experts are here to help analyse and identify patterns in your outgoings and incomings to predict peaks and troughs of your business’ accounts. Whether you’re a start up, or an established business, we will sit down with you and list out the items that you need to be recording as part of your cash flow management strategy.

Start-ups

Here at The Accountant Network we have years of experience in a wide range of business sectors and can provide tailored advice to help your startup succeed. Our highly experienced business accountants are specialists in helping startups thrive. From day one we can provide expert guidance in creating business plans to help raise finances, assist in setting up bank accounts right for your company, and develop specified tax strategies.

Price List

Basic Package

£50/Month

- Annual Accounts preparation and submission to Companies House

- Corporation Tax return preparation and submission to HMRC

- Confirmation statement preparation and submission

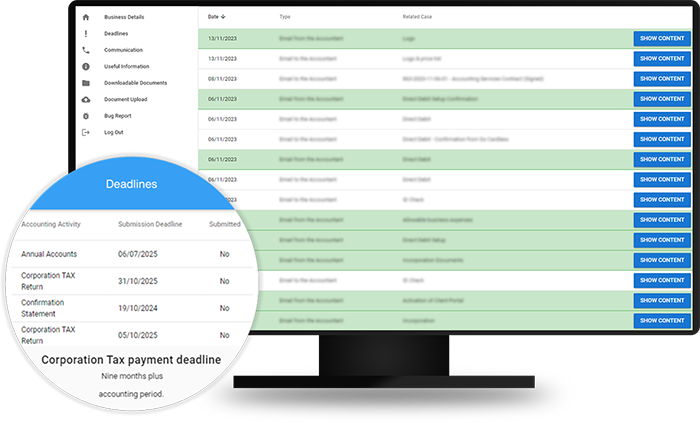

- Access to The Accountant Network’s Client Portal

- Access to our expense list

- E-mail consultation

- Telephone consultation

The package does not include bookkeeping. Tax return will be prepared based on the requested details and Profit & Loss Account provided by Client.

Non VAT Registered

£80/Month

- Annual Accounts preparation and submission to Companies House

- Corporation Tax return preparation and submission to HMRC

- Confirmation statement preparation and submission

- Access to The Accountant Network’s Client Portal

- Access to our expense list

- E-mail consultation

- Telephone consultation

- Bookkeeping for up to 2002 transaction per tax year

- Self Assessment for 1 Owner / Director

VAT Registered

£90/Month

- Annual Accounts preparation and submission to Companies House

- Corporation Tax return preparation and submission to HMRC

- Confirmation statement preparation and submission

- Access to The Accountant Network’s Client Portal

- Access to our expense list

- E-mail consultation

- Telephone consultation

- Bookkeeping for up to 2002 transaction per tax year

- Self Assessment for 1 Owner / Director

- Preparation and submission of VAT returns